Editors' Note: This article covers a stock trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks .

.

.

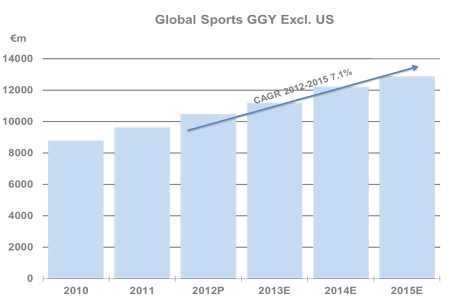

.Online gambling is not legal in a majority of the states in the U.S. However, few are easing their regulations to allow it to take place. Nonetheless, the business continues to thrive in Europe and other parts of the world as the shift to mobility makes it easier for players to place their bets on the go. According to reports, the online betting industry, excluding the U.S. will grow to about EUR 12.9B or $17.7B worth of gross gaming revenues by 2015. This represents nearly 23% growth rate from the EUR 10.5B or $14.4B worth as of December 2012. Therefore, the compounded annual growth rate "CAGR" stands at about 7.1%, and is expected to continue in the foreseeable future.

industry, excluding the U.S. will grow to about EUR 12.9B or $17.7B worth of gross gaming revenues by 2015. This represents nearly 23% growth rate from the EUR 10.5B or $14.4B worth as of December 2012. Therefore, the compounded annual growth rate "CAGR" stands at about 7.1%, and is expected to continue in the foreseeable future.

industry, excluding the U.S. will grow to about EUR 12.9B or $17.7B worth of gross gaming revenues by 2015. This represents nearly 23% growth rate from the EUR 10.5B or $14.4B worth as of December 2012. Therefore, the compounded annual growth rate "CAGR" stands at about 7.1%, and is expected to continue in the foreseeable future.

industry, excluding the U.S. will grow to about EUR 12.9B or $17.7B worth of gross gaming revenues by 2015. This represents nearly 23% growth rate from the EUR 10.5B or $14.4B worth as of December 2012. Therefore, the compounded annual growth rate "CAGR" stands at about 7.1%, and is expected to continue in the foreseeable future.

In this article I look at the main players as the paradigm shift to mobility continues, and also the type of opportunity they offer to investors. The industry appears to be dominated by four or five companies, includingPaddy Power (OTC:PDYPF), Ladbrokes (OTCPK:LDBKY), Betfair (OTC:BTFRF), Bwin (OTCPK:PYGMF) and William Hill (OTC:WIMHF), among others.

(OTC:BTFRF), Bwin (OTCPK:PYGMF) and William Hill (OTC:WIMHF), among others.

(OTC:BTFRF), Bwin (OTCPK:PYGMF) and William Hill (OTC:WIMHF), among others.

(OTC:BTFRF), Bwin (OTCPK:PYGMF) and William Hill (OTC:WIMHF), among others.There are ten or so others grappling for the remaining market share. Some joined a few years ago, but managed to gain significant market share enough to boost their market value substantially.

But first, how does online betting work?

work?

work?

work?Online betting , which is predominantly sport betting, exists in several countries. Most of the rules and characteristics are common across the different countries that allow it. Wagers are made in advance of or during sporting events in pursuit of an attractive return. The bookmaking process for online sports betting is structured in a similar manner to land based bookmaking. Normally operators distribute the bets in such a way that they would make a positive margin regardless of the result. However, due to advances in technology, which now allows live betting on events, operators have the ability to adjust the odds in such a way that favors the most unlikely outcome. Therefore, the more unlikely an outcome is, the higher the expected pay.

, which is predominantly sport betting, exists in several countries. Most of the rules and characteristics are common across the different countries that allow it. Wagers are made in advance of or during sporting events in pursuit of an attractive return. The bookmaking process for online sports betting is structured in a similar manner to land based bookmaking. Normally operators distribute the bets in such a way that they would make a positive margin regardless of the result. However, due to advances in technology, which now allows live betting on events, operators have the ability to adjust the odds in such a way that favors the most unlikely outcome. Therefore, the more unlikely an outcome is, the higher the expected pay.

, which is predominantly sport betting, exists in several countries. Most of the rules and characteristics are common across the different countries that allow it. Wagers are made in advance of or during sporting events in pursuit of an attractive return. The bookmaking process for online sports betting is structured in a similar manner to land based bookmaking. Normally operators distribute the bets in such a way that they would make a positive margin regardless of the result. However, due to advances in technology, which now allows live betting on events, operators have the ability to adjust the odds in such a way that favors the most unlikely outcome. Therefore, the more unlikely an outcome is, the higher the expected pay.

, which is predominantly sport betting, exists in several countries. Most of the rules and characteristics are common across the different countries that allow it. Wagers are made in advance of or during sporting events in pursuit of an attractive return. The bookmaking process for online sports betting is structured in a similar manner to land based bookmaking. Normally operators distribute the bets in such a way that they would make a positive margin regardless of the result. However, due to advances in technology, which now allows live betting on events, operators have the ability to adjust the odds in such a way that favors the most unlikely outcome. Therefore, the more unlikely an outcome is, the higher the expected pay.Who is who in the industry?

Companies located in the U.K. and the Republic of Ireland dominate the online betting industry. However, not all of them are entirely based online. In fact, a good number of them get a small percentage of revenue from online betting compared to other sources. Nonetheless, that does not mean that their online betting business has been underperforming. There are also those that get all their revenues from online betting activities. For instance, U.K.'s Betfair and Bet365 are some of the most successful online betting companies that generate all their revenues from online betting activities. There are also others trying to join the queue, albeit by use of some aggressive marketing techniques; SeanieMac(OTCQB:BETS), a new player in the business, PaddyPower, which successfully penetrated the U.K. market, and BSkyB's (OTCQX:BSYBY)Sky Bet, which has grown as a result of multiple acquisitions. Here is a summary of the comparable veteran companies' fundamentals for trailing twelve months based on the most recent quarter (ending Sep 30) results.

Paddy Power | William Hill | Betfair | Bwin | Ladbrokes | |||

Market Cap | $3.99B | $4.98B | $1.76B | $1.64B | $2.71B | intraday | |

Revenue | $935M | $2.25B | $601M | $950M | $1.77B | ttm | |

Debt | 0.00 | $1.44B | 0.00 | $45M | $648M | mrq | |

Cash | $233M | $273M | $275M | $230M | $45M | mrq | |

EBITDA | $222M | $589M | $128M | $144M | $397M | ttm | |

Operating Margin | 19.9% | 23.3% | 13% | 1% | 12.2% | ttm | |

Profit Margin | 17.7% | 14.9% | 9.4% | -7.3% | 11.2% | ttm |

Source of Data: Yahoo Finance

Paddy Power is an Irish bookmaker owned by Seamus Flynn. The company has offline betting offices and operated Ireland's largest telephone betting service. However, it is online gambling that its current CEO Patrick Kennedy sees the company growing to its potential in the next 10 years. The WSJ quoted Kennedy's following remarks after an investor conference:

"The global betting and gaming market is worth about $375 billion but only 9% is online. This is tiny and the proportion that's online is going to explode in the next 10 years."

The company appears strong fundamentally with a lot of cash and no debt against it. The company grew its revenues by 22% in the most recent quarter, while earnings were up 12.2% year-over-year.

When Paddy Power entered the U.K. sports betting market it launched an aggressive marketing campaign, which many thought would not pay off. However, results indicate that the Irish based bookmaker ranked fourthas of July 2012 in terms of net annual sports betting revenue, which accounts for more than 50% of its overall sports betting revenue. The company also engages in other online and betting activities including online Poker, Bingo and Casino. Casino and Bingo make the second and third largest gambling sectors after sports betting.

William Hill is the largest company in term of market capitalization. The company's fundamentals look strong despite the large amount of debt. It has good margins, which helps it ease on the expenses associated with the debt. Nonetheless, its current ratio of about 0.70 is undesirable, although the $273M worth of cash should help reduce its impact.

William Hill was founded in 1934 and is headquartered in London. The company owns and operates approximately 2,392 betting shops, most of which are located in the U.K. In the most recent quarter, William Hill grew its revenue and earnings by 19%. William Hill ranked third in a study conducted in July 2012, in terms of online net gaming revenue, behind Betfair and Bet365, and ahead of Paddy Power and Ladbrokes respectively.

Just like Paddy Power, William Hill is involved in more than just sports betting. It also engages in Casino, Bingo, and Poker. The company also runs a series of other betting resources including radio betting services, and reality TV betting shows among others.

Betfair is U.K's largest sports betting company. Unlike Paddy Power and William Hill, the company is based entirely online. It has no betting shops or radio betting service. Its online betting services are available in the U.K., Europe and internationally. Betfair was founded in the year 2000, and is headquartered in London, in the U.K.

Fundamentally, Betfair looks very stable with no debt on its balance sheet. It also has a huge amount of cash, which is nearly half the annual revenue. In the most recent quarter the company's revenues declined by 6%.

The company's free cash flow of $94M is a good incentive for expansion and the development of better betting platforms as it gears up to capitalize on the impending explosion of the online betting market.

Bwin operates under a several websites, each targeted at a particular online gambling sector. Its operations are divided into five, and are represented by six websites, including PartyBingo.com, PartyCasino.com, FoxyBingo.com, PartyPoker.com, GameBookers.com and PartyBets.com. All these target Sportsbook betting, Poker, Casino, events betting and Bingo.

The company provides sports betting services under various brand names, such as Bwin, an online sports betting service in continental Europe and South America. Its operation are based entirely online, and is headquartered in Gibraltar.

The company's fundamentals are not as impressive as those of Paddy Power and Betfair are. However, it has $61M worth of leveraged free cash flows, and a current ratio of 1.33. In the most recent quarter, the company's revenue declined by 16.5%, and stands at a loss making position based on annualized earnings for the last four quarters.

Bwin appears better valued than a majority of its rivals, trading at just 2.04 in price to book value compared to William Hill's 2.97x, Paddy Power's 10.65x, and Betfair's 7.26x.

Ladbrokes founded in 1886, is one of the oldest betting companies. It operates shops offering traditional over the counter betting on football, horse racing, greyhounds, and other sports, as well as gaming machines in Ireland, Belgium, the U.K., and Spain. Ladbrokes is headquartered in Harrow, the U.K., has more than 2,700 betting shops and machine, and supports 17 betting currencies.

In the most recent quarter, Ladbrokes revenues grew by 2.9%, while earnings fell by 58.5%. Its total cash of $45M, based on the most recent quarter results looks underwhelming when compared to a total debt of nearly $650M. Its current ratio is also unimpressive at 0.54, while its price to book value per share of 3.78x does not rank well when compared to some of its rivals.

per share of 3.78x does not rank well when compared to some of its rivals.

per share of 3.78x does not rank well when compared to some of its rivals.

per share of 3.78x does not rank well when compared to some of its rivals.The stock is down 9.7% over the last twelve months, compared to Betfair's rally of 38.5%, while Bwin and William Hill are up 12.2% and 11% respectively.

are up 12.2% and 11% respectively.

are up 12.2% and 11% respectively.

are up 12.2% and 11% respectively.Conclusion

It is clear that there is a huge opportunity in online gambling, especially for companies that can access markets where the exercise is allowed. This is good news even for new entrants and small players in the business like Sky Bet and SeanieMac. Additionally, more countries are easing their regulation on online gambling, which should help widen the addressable market going forward.

The U.S. is also beginning to relax its rules on the activity as one state after another continue to welcome the business as they seek to boost their tax revenues. For instance, Caesars (CZR) joint venture with 888 Holdings (OTC:EIHDF) seems to be leading the campaign in Las Vegas, while Nevada and New Jersey are also reportedly easing their policies on online gambling.

As the market grows, online betting companies stand a chance to gain most, as the shift to mobile continues to make it easier to participate in online gambling.

companies stand a chance to gain most, as the shift to mobile continues to make it easier to participate in online gambling.

companies stand a chance to gain most, as the shift to mobile continues to make it easier to participate in online gambling.

companies stand a chance to gain most, as the shift to mobile continues to make it easier to participate in online gambling.

Looking for the most reputable online casino? Join 888 Casino.

ReplyDelete